PART 3: THE MATH'S NOT MATHING.

How Mediocre Marketing Throws a Wrench

In Seamless, Profitable Scaling & Growth

LET'S RECAP, FOR CONTEXT.

Part 2: The Conversion-Crushing Emergence of The Perfect Storm (of Mediocre Marketing)

The Industry evolved with the help of a philosophy to scaling companies that I've coined Mediocre Marketing, and their profits-at-all-cost, shortcut-centric business ethos has become an invasive species when it comes to running companies, from operations and fulfillment to marketing and advertising... desensitizing, underwhelming and wearing out eCommerce consumers and eCommerce founders everywhere.

Mediocre Marketing goes deeper than surface-level marketing faux pas, seeping into the way business is done after the sale, reflecting how marketers and agencies are doing business and serving your accounts, and influencing how founders are being taught to run, optimize, grow and manage their own companies.

This school of thought is pervasive and systemic. It exists in all pockets of the internet marketing community and is not limited to a specific gender, race, background, or walk of life. This isn't just "bro marketing" and its practices are not limited to landing pages, emails, ad creative, or other elements of your marketing or advertising.

In fact, Mediocre Marketing hits eCommerce brands the hardest in the realm of data and analytics, teams, and management within and across marketing and operational silos of the business. This is why it so quietly and forcefully impacts performance.

It's not your fault that you're struggling to reach your eCommerce growth and scaling goals. The deck has been inadvertently stacked against you as you and eCommerce founders like you are being tossed around by The Perfect Storm of circumstances that stifle growth and profitability.

Before nearly a decade in advertising and scaling eCommerce brands, before my career in corporate strategy and investment banking, I dreamed of being a scientist.

And not just any ol' scientist. I had to do the most.

I dreamed of being an astrophysicist. A real-life, NASA-employed, Hidden Figures-inspired, calculator-toting astrophysicist. And it wasn't just a pipedream. It's what I studied in college, at one of the top astrophysics programs in the world, until I turned to more results-oriented pursuits junior year.

I won't bore you with how I spent my sophomore year as an actual astrophysics researcher, studying the hydrodynamic instabilities of supernovae by simulating explosions in the lab using lasers. My work did get published, but it's super dense stuff and definitely not nearly as relevant to the success of your eCommerce brand as what I'm about to give you to sink your teeth into.

I only brought this up so you can know that I'm dead serious when I say:

I'm obsessed with data. Math is my jam, fam.

And the strongest argument I found against Mediocre Marketing was right there, in the math itself.

And lucky you, you won't even have to know vector calculus or partial differential equations to see it. Basic division will do. But first, I need you to read and contemplate this:

DATA DOESN'T EXIST TO ANSWER THE QUESTION, "HOW MANY?". DATA EXISTS TO ANSWER THE QUESTION, "HOW COME?".

This is something you need to understand in order for the rest of this to make sense.

Competitive advantage is based almost exclusively on a brand's superior ability to predict what audiences are thinking and how they'll respond to certain stimuli.

And when you can discern the ontology of a customer–their very nature and state of being–you can understand who a customer is.

Therefore, you can then predict what they will do.

Discerning that ontology begins with mastering the ability to not only see the data, but to listen to it and hear exactly what it's really telling you. To read that data through the lens of identifying why something is happening (the story behind the numbers). In this, data is massively underutilized on this side of the industry for most emerging and challenger brands. It isn't mined enough, isn't analyzed enough, and it isn't leveraged enough. Because the wrong questions are often being asked.

When you shift the questions you ask of the data, the RIGHT answers become starkly more apparent and you can chart a clearer path to greater efficiency and more successful outcomes.

This is not only the cornerstone to consistently gaining the competitive edge, it's the driving force behind solving the right problems so that you can uncover the right solutions– for you and your brand– to growing and scaling intelligently and efficiently.

One of the first things I learned on Wall Street, as a bright-eyed, bushy-tailed analyst was how to ask the right questions of data and use the right answers to pinpoint and tell the overall business story.

Over the better part of a decade, it's a skill I've employed and trained our agency teams to soar with in everything we do.

And with over $130 million in ads data at our disposal and tens of millions more having consulted brands with scaling their companies on digital... the marketing, operational, and departmental numbers we've seen from a plethora of companies spanning 72 markets / niches across industries give us a complete story.

...that either predict a brand's ability to scale seamlessly, predictably, and profitably– a term we've coined as True Scalability– or forecast a brand's likelihood of inevitable failure... in the face of economic, market, channel, and platform volatility.

That is, we can see, in the data, a brand's propensity to remain successful even if (or when) $%#@ goes left and gets real.

The data is what first got my attention and made us realize Mediocre Marketing, this toxic, underperforming brand of revenue generation, was creating some very serious problems that business owners and founders weren't yet seeing.

1. Mediocre Marketing's Non-Inclusive Model Leaves Millions on The Table

If you want to see an example of how The Industry employs Mediocre Marketing to take shortcuts, make shortsighted business decisions, and generally create cracks and fissures in a brand's scaling architecture that aren't often apparent until it's almost too late...

Look no further than a space a lot of you are already familiar with (for better or worse):

Facebook ads.

In the media buying space, particularly for paid social, traditional media buyers are obsessed with this tunnel vision approach, focused singularly on surface-level KPIs and front-end metrics like cost-per-click, cost-per-purchase and ROAS. They allege these statistics reveal whether your advertising campaigns are successful.

And they would point to that...

...if you defined successful advertising campaigns in a silo, outside of the health of a business. Which they usually do. 🤦♀️ 🤦🏻♀️ 🤦🏽♀️ 🤦🏾♀️ 🤦🏿♀️

OR

...if you're only looking at the very front-end performance of your ads as the barometer by which you assess the success of your growth. Which is problematic for a litany of reasons I'll get into in a bit.

OR

...if, for example, you're marketing to exclude and filter out millions of people off the bat and intend to watch prospects fall off at every point of the customer journey (from viewing the ad to clicking through to the product to adding to cart to initiating checkout to purchase) with nothing in place to re-engage them but a few flimsy cart abandon emails and a retargeting ad or two.

Which leaves massive amounts of money on the table and destroys the efficiency of every marketing initiative you have in play.

These shortsighted assumptions and practices are built on shortsighted analyses that make brands jump to shortsighted conclusions. Which leads to shortsighted decisionmaking, yielding returns in the short-term that pale in comparison to what's been left on the table having opted out of the longer term play.

This is the impact of non-inclusive marketing. Where a marketer or marketing decisionmaker is driving marketing on pure volume, trying to reach broad audiences yet filtering out scores of potential buyers with a single narrowly-tailored targeting or message to grab the lowest hanging fruit, and ignoring the rest– potentially millions–who would have bought had they run into anything throughout the journey that spoke to their concerns, needs, and the way they digest information.

Yet that's the standard. Why? Because even though it's significantly less efficient, non-inclusive marketing is also significantly less work.

And with 15 to 30 accounts to contend with and a higher up breathing down their neck to scrape together enough time to add 5 more so they can hit the agency's revenue numbers next quarter, it's all they have time for.

So they take the easy way out and build and manage marketing funnels and consideration journeys that are so riddled with gaps and missing pieces that 98% (sometimes more) wander off without buying... usually never to be heard from again.

That's an awful lot of people. And an awful lot of money spent to get them to click through for naught.

Yet they're okay with that 1-2% conversion rate, some being blithely unaware that that sort of performance is below standard, and many knowing but not caring at all.

Because as far as an eCommerce media buyer is concerned, for example: they're only responsible for what's in the ad account and maybe the layout of a product page. They're not often focused on the optimization of the product, the strength of the front-end offer, or the myriad of ways it must be marketed to a myriad of audiences, at the same time.

The ads speak to one type of buyer, buying for one particular reason.

The product page is designed for another type of buyer, perhaps one with low-information attributes for instance.

The cart and checkout is designed for a different type of buyer still.

The cart recovery campaign speaks to one type of person who isn't buying for one type of reason (usually price sensitivity, even though there are SO many other reasons why other people pass on the product).

All other types of buyers, all other ways buyers consume information, all other types of reasons they would be intrigued or repelled, are ignored and fall off during what is usually severely inadequate testing in half-baked testing environments.

And even though the numbers are as clear as day, no one managing these accounts this way seems interested in discovering why the 9,800 people (or more) click through, intrigued about your product...and then change their mind and don't make a purchase at all. And certainly no one seems to be wondering what each channel's role is or isn't across that consideration process.

Now, some drop-off is unavoidable. But at that level? Contrary to popular belief, that should not be par for the course. It doesn't have to be. But ask around, and those who run Mediocre Marketing will sing a different tune.

Marketing decisionmakers rarely ask themselves the question, "How does the entire scaling architecture of the brand (the channels and their performance, tech stack, content, offers, retention stack, product costs, operational expenses, cashflow, and more) get in the way of our acquisition and scaling efforts? How does each channel support or impede the other in the goal of getting the sale? What roles do they play, if any, in plugging the gaps and holes across the buyer consideration process?"

That's the job. Taking every relevant element of the business into consideration before charting the path to smoother, seamless scaling and growth.

Traditional media buyers who generally work in isolation from other channels, don't consider the rest to be their responsibility. Even if there's plenty more purchases to be gained (more efficiently) from just taking the time to build things out properly. They're usually doing their best.They've just taken on so many other accounts and clients that they just don't have that kind of time and have spent so many years getting by with the bare minimum.

This is why they rely so heavily on 1 to 2% conversion rate benchmarks. But benchmarks are simply indicative of what the average marketers and business owners are achieving using Mediocre Marketing. They're not an indicator of what an eCommerce brand should expect when building a strong marketing program.

And if you're a brand that enjoys high impulse buy rates or is priced under, say, $20 – these conversion rate benchmarks would never even apply to you at all.

The reality is that scaling and growth is a lot more nuanced and model-dependent than everyone is willing to admit.

And truly great marketing and advertising defies the law of gravity by embracing that nuance and overcoming the inherent, pervasive resistance in the market. Part of that means getting different types of people, who consume information differently, who resonate at different frequencies, and who have different objections and use cases for your product, to mentally say YES at every microconversion, every microstep along the consideration process, along every unique sale path...

...after every line of copy, after every five seconds of a video, after every click they make around a product page, add to cart page, or checkout page.

Inclusive marketing doesn't just optimize the funnel. It optimizes the unique thought sequences that support the conversion, and it continues that process long after the first purchase to support additional conversions from that buyer over and over again, for years to come.

Not just on one channel. On all of them, in different ways. Operating in sync with one another and together, aligned with the operational realities of the business. This is critical not to gloss over; it's the crux of the whole argument.

And this. Takes. Work.

To save time and energy, most would rather simply acquiesce to the laws of gravity and allow 2x to 5x the number of buyers you could have had to simply fall through the cracks. Most would rather keep their heads down and not engage with, share data with, or learn from other teams on other channels or in other departments. Yet they'll just chalk the inefficiencies all up to the game.

This why the agenda –of traditional media buyers, marketing agencies, marketing managers and even CMOs– to sacrifice long-term stability and gains for short-game hacks and strategies in favor of bare bones, shortcut-driven fulfillment is often diametrically opposed to your own long-term goals and those of your brand.

LET ME GIVE YOU AN EXAMPLE OF HOW THIS TENDS TO PLAY OUT.

Take email marketing, for instance. Most email marketers will advise all their clients stick to a basic, product-oriented post-conversion flow of about 3 to 5 emails, spaced a day or so apart, to target those who already bought and encourage a repurchase.

But you sell a consumable product that takes 30 to 45 days before they're even thinking of re-upping and by the time they might need you again, they're already enamored with another brand who's captured their top of mind because your flow ended after 5 days.

Or, maybe you have a product that requires months of consistent use to work, like in the supplement space or much of the wellness space, and you need a meaningful, educational, motivational flow customized for purchasers to maximize retention.

You think those rinky-dink, 15%-off -our-next-purchase emails are going to drive your 12-month LTV high enough to withstand volatility on paid social? They won't. But that's what your email marketer is giving you, anyway. Why?

It's faster. It's less work. Who wants to write 10 to 30 emails to build the meaningful relationship needed to cross-sell, upsell into subscriptions, and land repurchases at higher order values if they're only charging $1500 to $3,000 a month? That would decimate their own profit margin.

So they push back and justify the refusal by informing you that your open rates will decline after the 2nd email and dwindle with each passing one. Which is true.

But they gauge their performance off of open rates. While you gauge your performance off of actual sales and improvements to your 3-month, 6-month, and 12-month LTV (or at least, you should). Like I said, your goals are often diametrically opposed.

And when your post-conversion flows don't take your unique model into account, you end drop out of sight and out of mind altogether, damn near guaranteeing you don't get the sales you ought to.

And let's not get started on those "better performance in 30 days or you don't pay" offers plaguing your social media feeds. These client-traps move the needle on the lowest-possible hanging fruit so you see the needle move on open rates and clickthroughs or cart abandons. However, the strategies are so shortsighted and focus exclusively on short-term, easy wins at the expense of structuring far more lucrative retention into the business that attracts consistent repurchases and long-term customer loyalty.

Then when someone like me comes along, peers into your data, and tells you your subscription rates and repurchase rates aren't high enough to sustain stronger scaling on the front-end, you wonder why. We'll dive deeper into that in a moment, but ultimately:

YOU'RE SPENDING WAY MORE MONEY ON REPLENISHING THE NEW PROSPECTS AND FIRST-TIME CUSTOMERS YOU'RE LOSING, EVERY SINGLE DAY, WHEN YOU HAVEN'T EVEN PUT IN ENOUGH ENERGY TOWARDS NURTURING, COMPELLING, AND GETTING THE MOST OUT OF THE ONES YOU'VE ALREADY PAID FOR.

Not only that, but you're analyzing the wrong data, in the wrong windows, and coming to the wrong conclusions about those leads, which hinders your ability to monetize properly off them down the line. And so you, dear Founder, your teams, and your brand, are inadvertently building a system that creates a top-heavy reliance on acquisition traffic in order to survive.

But using the same Facebook ads example, paid social traffic is the singlemost volatile traffic source around. Massively powerful, for sure–we've generated nearly $1.5 billion for our clients with it– but extremely volatile nonetheless. CPMs swing, markets shift at the drop of a hat, policies change, platforms glitch with every update Meta's product teams make without telling the public, the list goes on and on.

Just look at how many traditional media buyers and marketers lost their minds when Apple's iOS 14.5 hit. And again when iOS 17 rolled around. Literally every time a change hits, those who subscribe to the Mediocre Marketing school of thought are all abuzz.

Because when volatility hits, they've designed your marketing in a way that throws a wrench in your revenue in kind.

The top-heavy, one or two-channel, front-end focused nature of most scaling environments means your business rises and falls with the ebb and flow of your acquisition efforts. And because most brands have teams who are flying half-blind, only running with the data and insights specific to the channel they're tasked with managing, they're missing a lot of the revenue-generating, profitability-maximizing puzzle.

2. The Myth of Front-End Marketing & Front-End Profitability

In a backroom mastermind, I recently had a conversation with a group of media buyers, some names you've probably heard of, who were lamenting over one of their client accounts. The client wanted to shrink the ads budget because the ads weren't profitable, and the consensus was that was smart to do until enough tinkering could be done to get campaigns doing a target 2.8x ROAS again.

Nobody asked how soon they were landing the second purchase, on average.

Nobody asked whether the brand's capitalization was allowing them to hold off for profit in 30 to 45 days after purchase.

Nobody even asked what the brand was actually making on the front-end, taking into account the actual costs associated to make and ship the product.

ROAS, or return on ad spend, tells you very little about the health of a business and whether it should shrink budget, stay the course, or even start to scale its paid traffic or other marketing efforts. Neither does MER, or Marketing Efficiency Ratio.

Yet marketers who subscribe to Mediocre Marketing rely almost exclusively on these figures. That includes traditional media buyers, CMOs, marketing managers, and even directors of growth.

Yikes.

Now to be sure, there are some brands who really do need to pull back on budgets because when it comes to their first order value compared to the cost to acquire a new customer, the math ain't mathin'.

But there are many others who are needlessly stagnant, not realizing they're actually recouping their acquisition costs in a short enough window to, for example, be able to withstand a much lower ROAS than they're already getting and still be profitable.

In other words, they could be generating WAY more revenue than they are and could be scaling when they're not.

All because they've been looking at incomplete front-end profitability data, in a silo, without the critical contextual cues backend and operational data provide.

This is just one tiny example. This lack of diligence and context happens with performance on social media, email, SMS, a host of other marketing channels, in a host of different ways.

And for the longest time, founders and marketing decisionmakers alike didn't need to question any of this.

People are only sounding the alarms now because manufacturing, operational, marketing, and advertising costs have risen to a degree where the symptoms, as medical professionals say, are finally presenting themselves.

But the danger has existed for quite some time.

It's like how the best friend / parent / sibling / partner running into the ER with a patient on Grey's Anatomy after some tragic accident always seem fine and calm...until next thing you know they're projectile-vomiting blood, passing out in the visitor's room or falling into seizures on the floor.

To say now they're the ones in grave danger wouldn't be quite accurate. They were always in danger, since the moment the cars collided.

They just didn't know it, yet.

The headache was ignored. They were a little queasy but they dismissed it as anxiety and no one else was paying attention. It's all fun and games until they're the ones getting rushed into an operating room.

Alen Sultanic says it better than I could:

"Everyone makes buying decisions differently. People that need more education, people that need more time, people that need a specific concern addressed first, people that need it to be cheaper, people that need it to be lower risk to buy and use. Think about how to sell to the people who don't buy, because that's where all the money is. Because whoever matures the customer, owns the customer."

To a consumer, the only two brands that matter are:

The brand that introduced them to the problem, and

The brand that brought them the solution that got them to their ultimate goal.

And in eCommerce, the former quickly fades from memory. The brand that got them where they needed to be remains the brand that gets their money, time and time again.

You see, the repeat purchase (the back-end) is everything in a cashflow-centric business like eCommerce. Your ability to become Truly Scalable is not solely determined by front-end profitability, but by backend and overall profitability, too.

And Mediocre Marketers aren't looking at these figures, at all, let alone factoring them into their decisionmaking and analysis.

The result?

THIS LEADS TO BRANDS SCALING UP ON VARIOUS MARKETING AND ADVERTISING CHANNELS WHEN IT'S ACTUALLY NOT PROFITABLE TO DO SO, THEN DYING ON THE VINE AS A RESULT,

OR:

BRANDS PULLING BACK ON AD SPEND OR HALTING ADVERTISING ALTOGETHER WHEN THE DATA CLEARLY SAYS THAT THEY SHOULD AND COULD BE SCALING AND, WELL... DYING ON THE VINE AS A RESULT.

3. Tunnel-Vision Marketing Can Never Reach Peak Efficiency

To put it bluntly, those who ascribe to Mediocre Marketing aren't seeing the forest through the trees. They are not compelled to:

Communicate and collaborate with teams in the weeds in other marketing channels on behalf of the brand to leverage and share data that can derive smart strategies and yield more efficient outcomes,

Analyze operational and departmental data to drive profitability and take some level of PnL ownership,

Identify and lead opportunities across additional distribution channels that can expand reach and hedge channel risk,

Architect inclusive marketing strategies to speak to the 98% of click-through audiences that don't buy,

Assess cross-channel and intra-channel marketing strategies through the lens of profitability of the business overall, and

So many more instances where tunnel-vision runs rampant and leads to overspending, wasted budgets, inefficiency, redundant work, frustrated stakeholders, underwhelmed investors, frantic founders, and far more anxiety than is really necessary.

They just don't have the time. To them, that's too much work. 🙄

You can't open up your social media without finding someone who ascribes to Mediocre Marketing boasting about how s/he sold out a brand's entire inventory or skyrocketed their revenue. Screenshots galore. They can't help themselves; it gets likes, follows, and leads.

It's compelling. It's coveted. It's alluring.

But it's also a weird flex. Why? It actually points to a larger, deeper problem.

If you read between the lines you realize they're running superfluous traffic to an empty store, or forced to halt campaigns altogether. Even with a waitlist in place, the percentage of people who ultimately buy off of a waitlist is tiny compared to the volume of purchases you could have received had they been able to buy right then and there, right when they were most interested and impulsively driven to convert.

I mean, no one thought to sync with the fulfillment team or the Director of Operations to arrive at forecasting and get a sense of how and whether advertising should be paced or whether higher volumes of inventory should be ordered in advance?

REALLY, THOUGH?

This is how I can tell either a) the marketer doesn't know how to think about the overall business, b) stumbled upon revenue-generating campaigns accidentally with no actual replicable strategy in place, or c) doesn't think it's his or her problem. Except that stop-start-stop-start form of advertising absolutely does algorithmically do a number on your campaigns.

Or here's another one: a brand runs out of inventory but the marketing team keeps the marketing and sales faucets all the way on, full-speed ahead. Because they have goals to hit, they don't shut off the spigot, set up a waitlist, or indicate they're out of inventory. As a result, purchases pour in and the brand is now backlogged by several weeks to months to ship out orders. Customer service gets completely jammed, rendering them unable to adequately serve anyone effectively. Customers are furious and unsatisfied, and take to social media and comments on ads. And paid traffic campaigns suffer for months to years to come.

All because media buyers didn't take the time to have conversations with Ops and/or it never occurred to the CMO, growth director, or marketing manager to work with the COO to hedge that risk.

Womp womp.

These are yet more examples of the perils of shortsighted, tunnel-vision marketing, where individual accomplishments and goals take precedence over the collective health of the business. Where there's so much focus on revenue generation on the front-end and little thought to the overall business or its ability to generate sales and scale long-term.

So Why Is Mediocre Marketing So Dangerous?

In a nutshell, it either obfuscates or ignores the reality of just how unhealthy a business really is.

It's no wonder accountants and CFOs get so irritated by these types of marketers. After all, in this climate:

You don't have a thriving company if you're spending $80 to make $160 but it costs the brand $81 to fulfill and ship and the majority of returning customers aren't buying again for another 129 days.

You're not going to last long if the revenue you generate on average from new customers over 12 months is only 50% more than what you paid to acquire the first purchase.

A 70% increase in monthly revenue sounds cool, but means nothing if payroll increased by 170%, eating all your cashflow and you and you either run out of gas in the middle of the month after paying your people, or you have nothing to reinvest back into the business or even pay yourself with.

That math ain't mathin'.

And for most eCommerce challenger brands, there isn't a single marketer in the joint who is even crunching the numbers this way.

Which means there's a good chance that all this time, you've been flying blind.

And that was okay for a while, but now the climate has changed.

OKAY, BUT WHY ISN'T MEDIOCRE MARKETING WORKING ANYMORE?

Crudely put: these days, eCommerce consumers are smarter, stingier, and saltier. And rightfully so. Because Mediocre Marketing has run so rampant for so long:

They're more selective about whose email lists they opt into and who they give their data and contact information to.

They're more skeptical about marketing claims.

They want more personalization, authenticity, and care.

They have higher standards and expectations for the products they buy.

They've been burned before by traditional marketing and advertising methods that peddled products that didn't fulfill the promise.

They're more discerning, more jaded, and less responsive to overt, cringe sales and marketing tactics than ever before.

With eCom gurus flooding the market and technology lowering the barrier to entry, more brands are emerging than ever.

They're more skeptical about the authenticity of sales and discounts (thanks to Big Box Retail and their online stores).

They have more product options to choose from.

They also have less discretionary income due to inflation, or are inclined to save more in order to hunker down for the recession.

And top of all that: ad costs are rising, costs-per-action are rising, retargeting has gotten harder for most marketers who haven't cracked the code, and ad policies and algorithm updates that are getting smarter by the day are are getting harder and harder for many to continue to game with tactics, hacks, and strategies that when you really evaluate them: aren't strategies at all.

SEE? IT NO LONGER PAYS TO BE A MEDIOCRE MARKETER.

Here's the best example I can give to illustrate what's what's happened, what's happening today on the surface, and how things go down when you're singularly focused on the front-end, aren't thinking about how the pieces fit into the whole, and aren't optimizing your marketing and advertising channels or your overall business holistically.

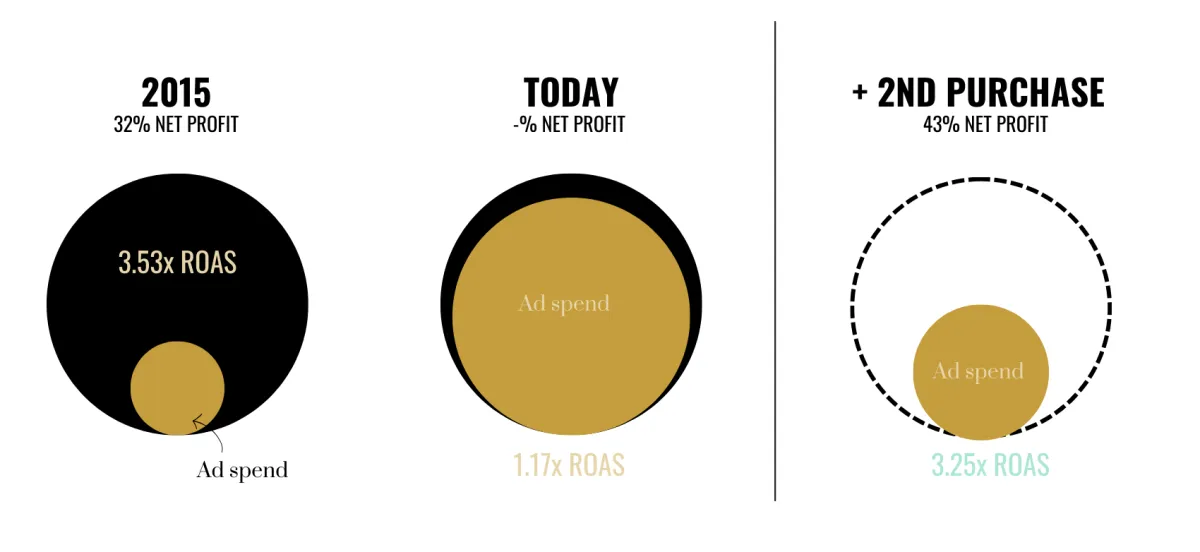

I had a business friend who was in distress because she claimed her advertising was no longer profitable. Back in 2015, her beauty brand was enjoying a 3.53x ROAS at 32% profitability, net of expenses.

10,000 click-throughs @ $0.87 = $8700

10,000 click-throughs @ 2.16% conversion = 216 sales = $30,672

Revenue - Ad Spend = $21,972

ROAS (Return on Ad Spend) = 3.53x

However, recently, like many eCommerce companies wandering out in the wilderness these days, her economics were in the toilet.

Thanks to The Perfect Storm, everything had changed.

10,000 click-throughs @ $1.57 = $15,700

10,000 click-throughs @ 1.33% conversion = 133 sales = $18,354

Revenue - Ad Spend = $2,654

ROAS (Return on Ad Spend) = 1.17x

And this doesn't even include actual COGS, or costs associated with manufacturing and shipping the product. So she and her team believed that her brand was really losing.

Not only were her Facebook and IG ads not profitable, she said, she was ready to throw in the towel on paid traffic altogether and try her hand at building out an influencer marketing program.

What she hadn't realized, however, is that the people who were buying her products from ads, also happened to love them. They were purchasing more products from her company (either the same product or complementary ones) about 28 days later, on average, at higher AOVs.

It wasn't until we pulled back the curtain on what was going on in her entire business holistically that it was revealed to her that these ads were giving positive value and were yielding profitability inside 30 days (even despite her subpotimal onsite conversion rate relative to the rest of her niche, rising ad costs, and downward trending AOV compared to 8 years ago). She just needed to shorten her cash conversion cycle or achieve that profitability a touch sooner to help with cashflow.

Don't get it twisted; she undoubtedly needed to optimize for first-order profitability to eke out a higher ROAS, but her situation was far from hopeless– especially since her media buyer had fallen behind in optimizing her campaigns and her director of growth hadn't been paying attention.

Limited bandwidth, I guess. 🙄

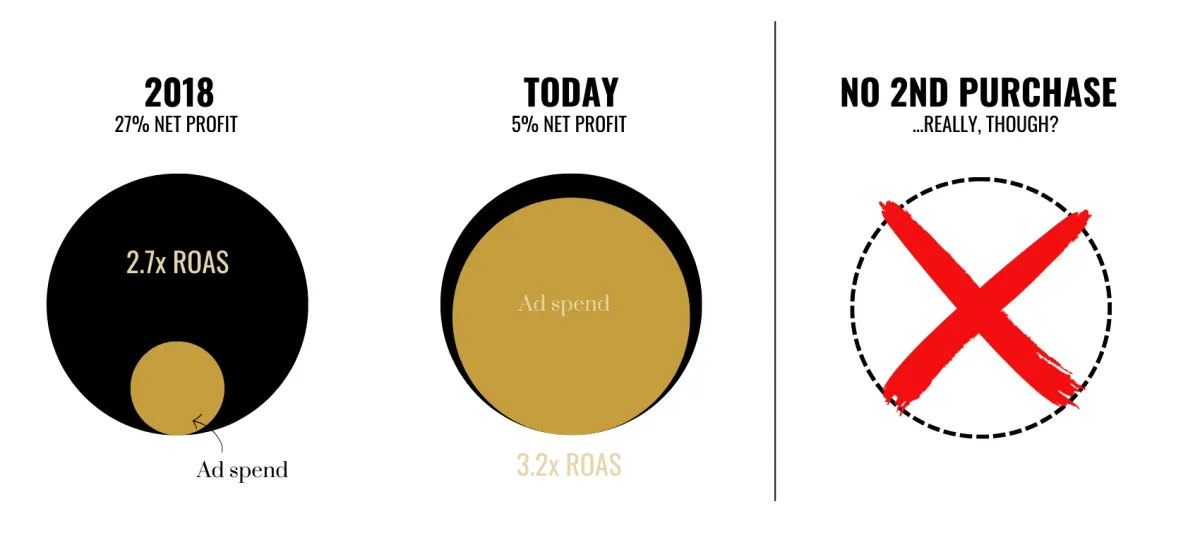

Here's a scarier example in the other direction, of a brand who thought their marketers were killing it but couldn't figure out why they never seemed to have any money.

Their agency told them they were seeing success since they were able to improve their ROAS amidst challenging, post iOS 14.5 conditions. Yet after overhead, agency fees, and other costs, the business wasn't profitable. They had a relatively short runway to get profitable, and their first round of funding was running dry.

On top of that, the repurchase rate was extremely low and they weren't maximizing revenue from their existing customers in any real way, so they hadn't been able to fuel growth without chasing more, more, more acquisition.

Like...is the success in the room with us? 👀 👀

What's worse, the agency advised that rather than build out a more robust email marketing program, the brand simply run post-conversion traffic, ballooning their over-reliance on a notoriously volatile platform.

I knew exactly what question to ask next:

What's the agency's fee structure?

They were charging the brand a percentage of ad spend. So the higher the spend...well, you get the gist. Not a bad thing in a vacuum, but in this case they were obviously offering advice that wasn't in the best interest of the brand, which tends to happen alarmingly often.

Some Mediocre Marketers will say anything to land higher fees.

Just a couple months ago, I heard from this brand again. Facebook removed the targeting they'd been using to achieve optimal ROAS. Now they were fully sunk, couldn't regain their footing, and had no channel diversification to weather the storm.

Platform and channel volatility can bite a brand right in the butt, if they're not ready for it.

TL;DR: CONTEXT IS EVERYTHING. AND YOU CAN'T GET THE CONTEXT

UNLESS YOU GET AND EVALUATE ALL THE DATA. THE ENTIRE BUSINESS STORY.

Here's your new reality:

You're not ever going to turn a profit on your paid acquisition traffic if the COGS (cost of goods sold) on your product mix is outside your threshold of tolerance.

You might always live and die at the mercy of front-end ROAS if your customers don't buy anything from you again for another 4 months..or at all.

You're not going to reach your acquisition targets at peak profitability on paid social if you haven't been structuring your other marketing and advertising channels to play along.

You may constantly find yourself floundering with every Facebook ads algorithm update if you're still not diversifying with, paying attention to or making optimizations based on the insights from your other channels and teams, like email, SMS, experiential marketing, and social media.

You'll never pick up steam and momentum if you're always having to halt campaigns because you're not adequately forecasting or planning for inventory.

When ad costs rise, platforms go wonky, markets shift, and tsunamis hit, you MUST have strong scaling architecture in place to maximize profitability, achieve stability, and not only weather the storm, but sail over the storm clouds entirely.

You've got to architect a business that can draw and leverage connections from the data across the entire business if you want to be able to scale profitably, no matter the climate, no matter the volatility existing outside (or within) your control–even when your competitors feel like they can't.

And if you don't establish a system that connects these dots to collectively build that stronger infrastructure?

Your days in eCommerce are numbered. Period. Fin. End of Discussion.

SO ARE WE WASTING OUR TIME WITH DIRECT-TO-CONSUMER?

IS PAID SOCIAL A LOST CAUSE?

SHOULD WE GIVE UP ON DIGITAL AND FOCUS ENTIRELY ON RETAIL?

IS PAID TRAFFIC A DYING OPTION FOR SMALL BUSINESS?

No. Not even a little bit.

And I have hundreds of thousands of datapoints, tens of thousands of documented campaigns, and oodles of case studies to prove my point (you'll see some in a minute).

But I'll Tell You What IS A Lost Cause:

Mediocre Marketing and all the ignorance of the nuances of the business that comes along with it.

Lazy, rushed-through, overextended media buying.

Poorly forecasted inventory management.

Sacrificing long-term returns for short-term gains (be it revenue or time).

Incompetent marketing leadership.

Haphazard data analysis.

Imbalanced marketing mixes.

ROAS and MER-centric decisionmaking.

Growth and performance analyses that ignore actual profitability.

Disjointed teams, agencies, and departments that don't share data, leverage data or get in sync.

Lackluster messaging and creative concepts that look and sound like everyone else.

CMO-level decisionmaking that ignores the realities of a cashflow-centric business model.

A SHIFT IS COMING.

eCommerce brands aren't going to be able to withstand so many bottlenecks, gaps, disjointed strategies and programs, and oversights lying dormant in their businesses much longer. Costs are rising, consumers are tightening their purse strings, and margins are disappearing.

Especially for brands lacking the know-how to architect a business that actually supports scaling and growth rather than stifles it.

But there is a different way to grow and scale your business– a way that hails real profitability, creates strong cashflow, makes you virtually bulletproof to economic, market, channel and platform volatility, and gives you in return a brand, a business, and marketing and advertising programs you can be incredibly proud of.

Okay. What's the Catch?

There's only one. In order for this new approach to make sense, you have to be willing to throw two things right out the window.

The idea that continuing to analyze your marketing, advertising, operations, and fulfillment in silos, by channel or department, will take you to your seven, eight, or nine figures in this climate.

And second, the notion that the only things that play a role in your ability to scale are your paid traffic performance and the conversion rate on your website.

Because if you and your teams are still thinking this way, you won't be able to make this work. These ideas are completely incongruent with what I'm about to show you.

However, if you can shift your perspective and adopt a new paradigm when it comes to growth and scaling, it's going to completely change the game for you as a founder, for your teams, and for your brand: your advertising, your marketing, your business performance, your operations, your customer and retail partner relationships.

Your whole business.

Up Next: Part 4 - The Latest Key to Profitable Scaling & Growth in eCommerce

IN A NUTSHELL:

The traditional methods of taking a tunnel-vision, shortcut-oriented, lowest-hanging fruit approach to marketing that excludes most of your prospects, ignores contextual business data and sacrifices longevity and profitable performance is not cutting it anymore. You can't just obsess over ads alone and reach peak profitability or performance in your business.

Mediocre Marketing is dying. It ignores the most critical elements to building a brand that can stand the test of time. This school of marketing and scaling will no longer be enough to overcome the significant and numerous market, channel and platform challenges facing eCommerce brands now.

Direct-to-consumer isn't dying and neither are Facebook ads. BUT growth strategies– especially those that lean heavily on paid social– have stopped working for any eCommerce business whose scaling architecture is weak and lacks the right contextual data to tell the real business story.

To make a breakthrough, you're going to have to first realize that architecting, analyzing, monitoring, and optimizing your marketing channels in a silo isn't going to cut it anymore. Neither will continuing to subscribe to the notion that your ad accounts and your website contain the only levers that need to be pulled to improve your paid traffic performance. Then the key to scaling and growth (on the next page) comes a lot easier.

Psssst, these publications have sought out my insights and expertise.

COPYRIGHT © TRULYSCALABLE.COM | ALL RIGHTS RESERVED | DISCLAIMER | TERMS & CONDITIONS | PRIVACY POLICY